User:Rosewater238/Behavioral economics

| This is the sandbox page where you will draft your initial Wikipedia contribution.

If you're starting a new article, you can develop it here until it's ready to go live. If you're working on improvements to an existing article, copy only one section at a time of the article to this sandbox to work on, and be sure to use an edit summary linking to the article you copied from. Do not copy over the entire article. You can find additional instructions here. Remember to save your work regularly using the "Publish page" button. (It just means 'save'; it will still be in the sandbox.) You can add bold formatting to your additions to differentiate them from existing content. |

Article Draft[edit]

Lead[edit]

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals or institutions, such as how those decisions vary from those implied by classical economic theory.[1][2]

Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory.[3][4] The study of behavioral economics includes how market decisions are made and the mechanisms that drive public opinion.

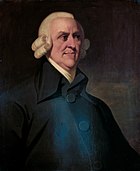

The concepts used in behavioral economics today can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires.[5]

The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century.[6][7] Behavioral economics is still growing as a field, being used increasingly in research and in teaching.[8]

Article body[edit]

History[edit]

Early Neoclassical economists included psychological reasoning in much of their writing, though psychology at the time was not a recognized field of study.[9] In The Theory of Moral Sentiments, Adam Smith wrote on concepts later popularized by modern Behavioral Economic theory, such as loss aversion.[9] Jeremy Benthham, another Neoclassical economist in the 1700s conceptualized utility as a product of psychology.[9] Other Neoclassical economists who incorporated psychological explanations in their works included Francis Edgeworth, Vilfredo Pareto and Irving Fisher.

A rejection and elimination of psychology from economics by the Neoclassical school in the early 1900s brought on a period defined by a reliance on empiricism.[9] There was a lack of confidence in hedonic theories, which saw pursuance of maximum benefit as an essential aspect in understanding human economic behavior.[6] Hedonic analysis had shown little success in predicting human behavior, leading many to question its accuracy.[6]

There was also a fear among economists that the involvement of psychology in shaping economic models was inordinate and a departure from contemporary Neoclassical principles. [10] William Peter Hamilton, Wall Street Journal editor from 1907 to 1929, wrote in The Stock Market Barometer: "We have meddled so disastrously with the law of supply and demand that we cannot bring ourselves to the radical step of letting it alone."[11][12]

To boost the ability of economics to predict accurately, economists started looking to tangible phenomena rather than theories based on human psychology.[6] Psychology was seen as unreliable to many of these economists as it was a new field, not regarded as sufficiently scientific.[9] Though a number of scholars expressed concern towards the positivism within economics, models of study dependent on psychological insights became rare.[9] Economists instead conceptualized humans as purely rational and self-interested decision makers, illustrated in the concept of homo economicus.[12]

The re-emergence of psychology within economics that allowed for the spread of behavioral economics has been associated with the cognitive revolution.[9][7] In the 1960s, cognitive psychology began to shed more light on the brain as an information processing device (in contrast to behaviorist models). These developments spurred economists to reconsider how psychology could be applied to economic models and theories.[9] Concurrently, the Expected utility hypothesis and discounted utility models began to gain acceptance. In challenging the accuracy of generic utility, these concepts established a practice foundational in behavioral economics: Building on standard models by applying psychological knowledge.[6]

Further steps were taken by Maurice Allais in setting out the Allais paradox, a decision problem he first presented in 1953 that contradicts the expected utility hypothesis.

In the 1960s, cognitive psychology began to shed more light on the brain as an information processing device (in contrast to behaviorist models). Psychologists in this field, such as Ward Edwards,[13] Amos Tversky and Daniel Kahneman began to compare their cognitive models of decision-making under risk and uncertainty to economic models of rational behavior.

Mathematical psychology reflects a longstanding interest in preference transitivity and the measurement of utility.[14]

Behavioural economics was originally proposed by John Maurice Clark, a University of Chicago faculty member, in the January 1918 issue of the Journal of Political Economy in a piece titled "Economics and Modern Psychology 1". The initial proposal he made, birthing behavioural economics, was that the economist may attempt to ignore psychology, but it is a sheer impossibility for him to ignore human nature. The paper presented further ideas such as 'desire as a reaction to stimulus', proposing that one shall manage his income as economically as his environment equips and enables him to manage it.[15]

During the classical period of economics, microeconomics was closely linked to psychology. For example, Adam Smith wrote The Theory of Moral Sentiments, which proposed psychological explanations of individual behavior, including concerns about fairness and justice.[5] Jeremy Bentham wrote extensively on the psychological underpinnings of utility. Then, during the development of neoclassical economics, economists sought to reshape the discipline as a natural science, deducing behavior from assumptions about the nature of economic agents. They developed the concept of homo economicus, whose behavior was fundamentally rational. Neo-classical economists did incorporate psychological explanations; this was true of Francis Edgeworth, Vilfredo Pareto and Irving Fisher. Economic psychology emerged in the 20th century in the works of Gabriel Tarde,[16] George Katona,[17] and Laszlo Garai.[18] Expected utility hypothesis and discounted utility models began to gain acceptance, generating testable hypotheses about decision-making given uncertainty and intertemporal consumption, respectively.

Observed and repeatable anomalies eventually challenged those hypotheses, and

Development of Behavioral Economics[edit]

In 2017, Niels Geiger, a lecturer in economics at the University of Hohenheim conducted an investigation into the proliferation of behavioral economics.[19] Geiger's research looked at studies that had quantified the frequency of references to terms specific to behavioral economics, and how often influential papers in behavioral economics were cited in journals on economics.[19] The quantitative study found that there was a significant spread in behavioral economics after Kahneman and Tversky's work in the 1990s and into the 2000s.[19]

| 1979 Paper | 1992 Paper | 1974 Paper | 1981 Paper | 1986 Paper | |

|---|---|---|---|---|---|

| 1974-78 | 0 | 0 | 1 | 0 | 0 |

| 1979-83 | 1 | 0 | 4 | 3 | 0 |

| 1984-88 | 7 | 0 | 0 | 1 | 0 |

| 1989-93 | 19 | 1 | 2 | 6 | 3 |

| 1993-98 | 37 | 16 | 12 | 7 | 6 |

| 1999-2003 | 51 | 20 | 5 | 15 | 11 |

| 2004-08 | 80 | 48 | 18 | 15 | 16 |

| 2009-13 | 161 | 110 | 59 | 38 | 19 |

| Total Citations | 356 | 195 | 101 | 85 | 55 |

Honors and Awards Recipients[edit]

Nobel Prize[edit]

1978 - Herbert Simon[edit]

In 1978 Herbert Simon was awarded the Nobel Memorial Prize in Economic Sciences "for his pioneering research into the decision-making process within economic organizations".[20] Simon earned his Bachelor of Arts and his Ph.D. in Political Science from the University of Chicago before going on to teach at Carnegie Tech.[21] Herbert was praised for his work on bounded rationality, a challenge to the assumption that humans are rational actors.[22]

2001 - George Akerlof, Michael Spence, and Joseph Stiglitz[edit]

The Royal Swedish Academy of Sciences stated George Akerlof, Michael Spence and Joseph Stiglitz received the Nobel Memorial Prize in Economic Sciences in 2001 "for their analyses of markets with asymmetric information."[23] Akerlof's work looked into adverse selection, emphasizing the importance of information within markets, while Spence and Stiglitz made insights on signalling and screening, respectively.[23] Their work on markets challenged standard theories within economics.[24]

2002 - Daniel Kahneman and Vernon L. Smith[edit]

In 2002, psychologist Daniel Kahneman and economist Vernon L. Smith were awarded the Nobel Memorial Prize in Economic Sciences. Kahneman was awarded the prize "for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty", while Smith was awarded the prize "for having established laboratory experiments as a tool in empirical economic analysis, especially in the study of alternative market mechanisms."[25]

2013 - Robert J. Shiller[edit]

In 2013, economist Robert J. Shiller received the Nobel Memorial Prize in Economic Sciences along with Eugene Fama and Lars Peter "for their empirical analysis of asset prices" within the field of behavioral finance, as according to the press release from the Royal Swedish Academy of Sciences.[26] Shiller discovered that one can more accurately predict stock prices in the long-run compared to the short run.[26] He also hypothesized that rational actors cannot be responsible for stock prices in the short-run due to uniquely large fluctuations.[26][27]

2017 - Richard Thaler[edit]

[28] In 2017, economist Richard Thaler was awarded the Nobel Memorial Prize in Economic Sciences for "his contributions to behavioral economics and his pioneering work in establishing that people are predictably irrational in ways that defy economic theory."[29][30] Thaler was especially recognized for presenting inconsistencies in standard Economic theory and for his formulation of mental accounting and liberal paternalism.[31]

Other Awards[edit]

1999 - Andrei Shleifer[edit]

The work of Andrei Shleifer focused on behavioral finance and made observations on the limits of the efficient market hypothesis.[7] Shleifer received the 1999 John Bates Clark Medal from the American Economic Association for his work.[32]

2001 - Matthew Rabin[edit]

Matthew Rabin received the "genius" award from the MarArthur Foundation in 2000.[7] The American Economic Association chose Rabin as the recipient of the 2001 John Bates Clark medal. Rabin's awards were given to him primarily on the basis of his work on fairness and reciprocity, and on present bias.[33]

2003 - Sendhil Mullainathan[edit]

Sendhil Mullainathan was the youngest of the chosen MacArthur Fellows in 2002, receiving a fellowship grant of $500,000 in 2003.[34][7] Mullainathan was praised by the MacArthur Foundation as working on economics and psychology as an aggregate.[7] Mullainathan's research focused on the salaries of executives on Wall Street; he also has looked at the implications of racial discrimination in markets in the United States.[35][7]

==[edit]

*Copied from Behavioral Economics. Bolded text is my contribution. ====

Kahneman and Tversky in the late 1960s published about 200 works, most of which relate to psychological concepts with implications for behavioral finance.

References[edit]

- ^ Lin, Tom C. W. (16 April 2012). "A Behavioral Framework for Securities Risk". Seattle University Law Review. SSRN. SSRN 2040946.

- ^ Zeiler, Kathryn; Teitelbaum, Joshua (2018-03-30). "Research Handbook on Behavioral Law and Economics". Books.

- ^ "Search of behavioural economics". in Palgrave

- ^ Minton, Elizabeth A.; Kahle, Lynn R. (2013). Belief Systems, Religion, and Behavioral Economics: Marketing in Multicultural Environments. Business Expert Press. ISBN 978-1-60649-704-3.

- ^ a b Ashraf, Nava; Camerer, Colin F.; Loewenstein, George (2005). "Adam Smith, Behavioral Economist". Journal of Economic Perspectives. 19 (3): 131–45. doi:10.1257/089533005774357897.

- ^ a b c d e Agner, Erik (2021). A course in Behavioral Economics (3rd ed.). Red Globe Press. pp. 2–4. ISBN 978-1-352-01080-0.

- ^ a b c d e f g Sent, Esther-Mirjam (2004). "Behavioral Economics: How Psychology Made Its (Limited) Way Back into Economics". History of Political Economy. 36 (4): 735–760. ISSN 1527-1919 – via Project MUSE.

- ^ Geiger, Niels (2017). "The Rise of Behavioral Economics: A Quantitative Assessment". Social Science History. 41 (3): 555–583. doi:10.1017/ssh.2017.17. ISSN 0145-5532.

- ^ a b c d e f g h Camerer, Colin; Loewenstein, George; Rabin, Matthew (2004). Advances in Behavioral Economics. Princeton University Press. pp. 4–6. ISBN 9780691116822.

- ^ Hansen, Kristian Bondo; Presskorn-Thygesen, Thomas (July 2022). "On Some Antecedents of Behavioural Economics". History of the Human Sciences. 35 (3–4): 58–83. doi:10.1177/09526951211000950.

- ^ Brown, Stephen J.; Goetzmann, William N.; Kumar, Alok (January 1998). "The Dow Theory: William Peter Hamilton's Track Record Reconsidered". The Journal of Finance. 53 (4): 1311–1333 – via JSTOR.

- ^ a b Boyd, Richard (Summer 2020). "The Early Modern Origins of Behavioral Economics". Social Philosophy & Policy. 37 (1). Oxford: Cambridge University Press: 30–54. doi:10.1017/S0265052520000035.

- ^ "Ward Edward Papers". Archival Collections. Archived from the original on 2008-04-16. Retrieved 2008-04-25.

- ^ Luce 2000.

- ^ clark, john (1918). "Economics and Modern Psychology 1". The Journal of Political Economy: 4–11.

- ^ Tarde, G. (1902). "Psychologie économique" (in French).

- ^ Katona, George (2011). The Powerful Consumer: Psychological Studies of the American Economy. Literary Licensing, LLC. ISBN 978-1-258-21844-7.

- ^ Garai, Laszlo (2017). "The Double-Storied Structure of Social Identity". Reconsidering Identity Economics. New York: Palgrave Macmillan. ISBN 978-1-137-52561-1.

- ^ a b c d Geiger, Niels (2017). "The Rise of Behavioral Economics: A Quantitative Assessment". Social Science History. 41 (3): 555–583. doi:10.1017/ssh.2017.17. ISSN 0145-5532.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1978".

- ^ Velupillai, K. Vela; Venkatachalam, Ragupathy (2021). "Herbert Alexander Simon: 15th June, 1916–9th February, 2001 A Life". Computational Economics. 57 (3): 795–797. doi:10.1007/s10614-018-9811-z. ISSN 0927-7099.

- ^ Leahey, Thomas H. (2003). "Herbert A. Simon: Nobel Prize in Economic Sciences, 1978". American Psychologist. 58 (9): 753–755. doi:10.1037/0003-066X.58.9.753. ISSN 1935-990X.

- ^ a b "Press Release from the Royal Swedish Academy of Sciences". The Scandinavian Journal of Economics. 104 (2): 193–194. 2002. ISSN 0347-0520.

- ^ Löfgren, Karl-Gustaf; Persson, Torsten; Weibull, Jörgen W. (2002). "Markets with Asymmetric Information: The Contributions of George Akerlof, Michael Spence and Joseph Stiglitz". The Scandinavian Journal of Economics. 104 (2): 195–211. ISSN 0347-0520.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2002". Nobel Foundation. Retrieved 2008-10-14.

- ^ a b c "The Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel, 2013". The Scandinavian Journal of Economics. 116 (3): 591–592. 2014. ISSN 0347-0520.

- ^ Wessel, David (2014-03-26). "Robert Shiller's Nobel Knowledge". Wall Street Journal. ISSN 0099-9660. Retrieved 2022-10-04.

- ^ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2013". Nobel Foundation. Retrieved 2016-07-01.

- ^ Appelbaum, Binyamin (2017-10-09). "Nobel in Economics is Awarded to Richard Thaler". The New York Times. Retrieved 2017-11-04.

- ^ Carrasco-Villanueva, Marco (2017-10-18). "Richard Thaler y el auge de la Economía Conductual". Lucidez (in Spanish). Retrieved 2018-10-31.

- ^ Earl, Peter E. (2018). "Richard H. Thaler: A Nobel Prize for Behavioural Economics". Review of Political Economy. 30 (2): 107–125. doi:10.1080/09538259.2018.1513236.

- ^ Blanchard, Olivier (2001). "In Honor of Andrei Shleifer: Winner of the John Bates Clark Medal". The Journal of Economic Perspectives. 15 (1): 189–204. ISSN 0895-3309.

- ^ Uchitelle, Louis (2001). "Economist Is Honored For Use Of Psychology". New York Times. ISSN 0362-4331.

- ^ Pais, Arthur J. (2002). "Economist Mullainathan is MacArthus 'Genius'". India Abroad. ISSN 0046-8932.

- ^ Lee, Felicia R. (2002). "Winners of MacArthus Grants Announced". New York Times. ISSN 0362-4331 – via Proquest.